Tourism in Nepal demonstrated strong resilience and maturity in 2025, successfully reaching near pre-pandemic performance levels while avoiding the pitfalls of mass tourism. According to data and industry insights aligned with the Nepal Tourism Board, Nepal welcomed 1,158,459 international visitors, achieving a 97% recovery compared to 2019.

Rather than being a short-term rebound, 2025 represents a transition year, marking Nepal’s shift from post-pandemic recovery to stable, sustainable, and value-driven growth. Consequently, this evolution creates new opportunities for premium experiences, diversified markets, and higher economic yield per visitor.

Overall Performance Snapshot

- Total International Visitor Arrivals (IVAs): 1,158,459

- Recovery Level: 97% of pre-pandemic (2019) arrivals

- Trend vs 2024: Moderate growth, signaling stabilization

Key Insight:

Nepal’s tourism recovery has been measured and balanced, avoiding overtourism and excessive discounting. As a result, the destination is well-positioned for long-term competitiveness, rather than short-lived volume spikes.

Seasonal Performance: Why December 2025 Matters

December 2025 recorded 98,190 international arrivals, reflecting:

-

+7% year-on-year growth compared to December 2024

-

97% recovery compared to December 2019

What This Indicates:

Winter tourism in Nepal is no longer a secondary season. Instead, demand for winter trekking, cultural tours, wellness travel, and soft adventure remains consistent and dependable.

Strategic Opportunity:

Therefore, the winter season provides an ideal platform to promote luxury trekking, boutique lodges, slow travel, wellness retreats, photography tours, and curated cultural journeys, particularly for long-haul markets.

Top Source Markets

| Market | Share | Strategic Interpretation |

|---|---|---|

| India | 25.2% | High volume, low yield; backbone market |

| USA | 9.7% | High-value, long-stay travelers |

| China | 8.2% | Recovering market with strong upside |

| UK | 5.1% | Stable trekking and heritage demand |

| Bangladesh | 5.0% | Growing short-haul family travel |

Market Insight:

Nepal benefits from a diversified source market mix, which reduces dependency risk. However, while India dominates in volume, long-haul travelers from the USA and Europe contribute disproportionately to tourism income.

Region-Wise Distribution: Volume vs Value

- South Asia (35.2%) – High volume, price-sensitive

- Asia (Other) (21.9%) – Growth engine (China, Southeast Asia, Korea, Japan)

- Europe (19.1%) – Core trekking and cultural market

- Americas (11.7%) – Highest spending per visitor

- Oceania (4.6%) – Loyal adventure niche

- Middle East, Africa & Others (7.7%) – Emerging and under-tapped

Opportunity for Tourism in Nepal:

Thus, the future growth strategy should shift focus from merely increasing arrival numbers to maximizing revenue per visitor, which will reduce pressure on infrastructure while increasing economic impact.

Economic Impact: Confidence Beyond Arrivals

Foreign Currency Earnings:

In the first four months of FY 82/83 (Shrawan–Kartik), tourism generated NRs. 27,152.55 million in foreign currency.

Interpretation:

This early-year performance indicates healthier pricing, longer stays, and increased service consumption across accommodation, trekking, and experiential tourism.

Tourism Foreign Direct Investment (FDI):

- NRs. 30,263 million committed

- 476 tourism-related projects approved

Investor Signal:

These commitments demonstrate that tourism investors are focused on long-term assets such as hotels, eco-resorts, boutique lodges, and trekking infrastructure—signaling confidence in Nepal’s tourism fundamentals.

Key Strengths of Tourism in Nepal

- Near full recovery without mass tourism pressure

- Balanced mix of regional and long-haul markets

- Growing investor confidence and FDI inflow

- Winter tourism emerging as a core revenue season

- Strong global reputation in trekking and adventure tourism

Gaps and Risks:

- Overreliance on low-yield short-haul markets

- China market recovery still below full potential

- Infrastructure and service quality gaps for premium positioning

- Limited global branding beyond trekking

Strategic Recommendations

-

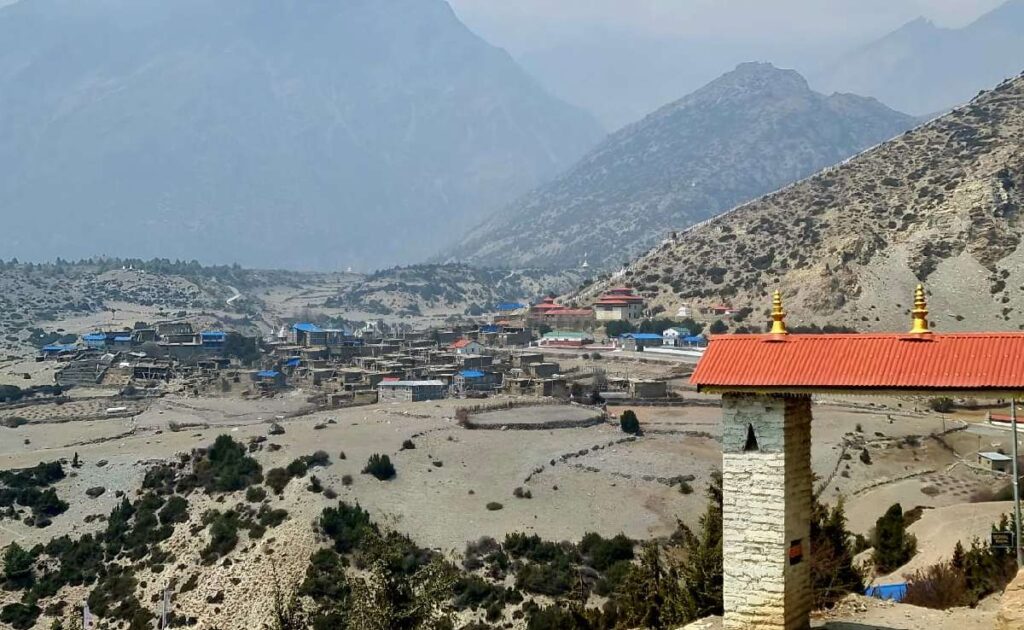

Move from Volume to Value

Promote luxury trekking, heli tours, wellness retreats, heritage trails, and slow travel experiences targeting high-spending markets in Europe, the Americas, and Oceania. -

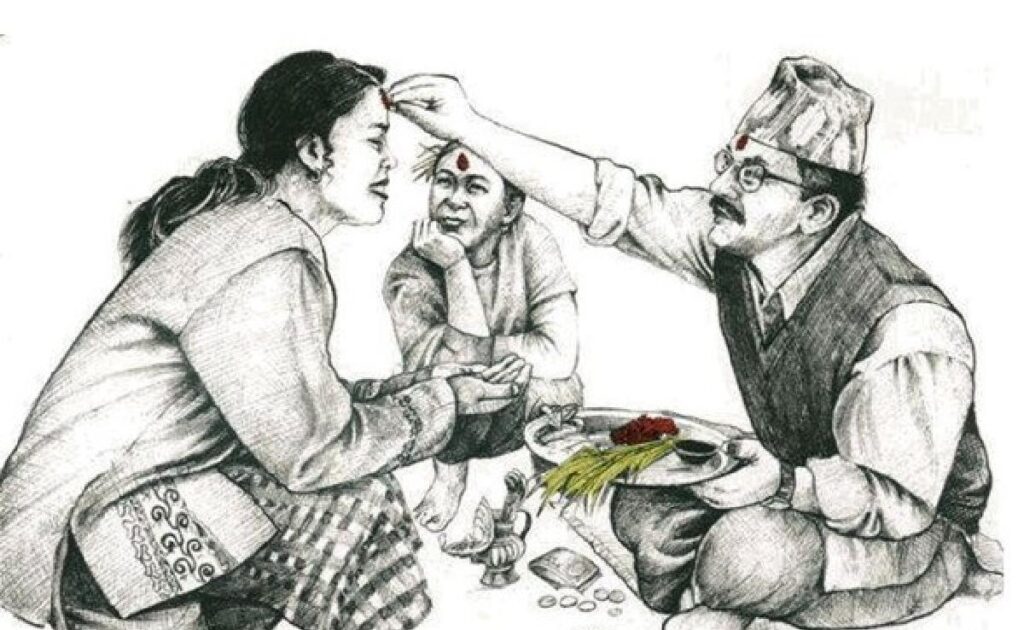

Reposition the India Market

Expand beyond pilgrimage and budget travel to luxury weekend escapes, destination weddings, adventure tourism, and curated experiences. -

Accelerate China Market Recovery

Invest in Mandarin-language content, influencer marketing, improved air connectivity, and digital visibility tailored to Chinese travelers. -

Capitalize on FDI Momentum

Encourage investment in eco-resorts, boutique lodges, community-based tourism, and experiential products that extend length of stay. -

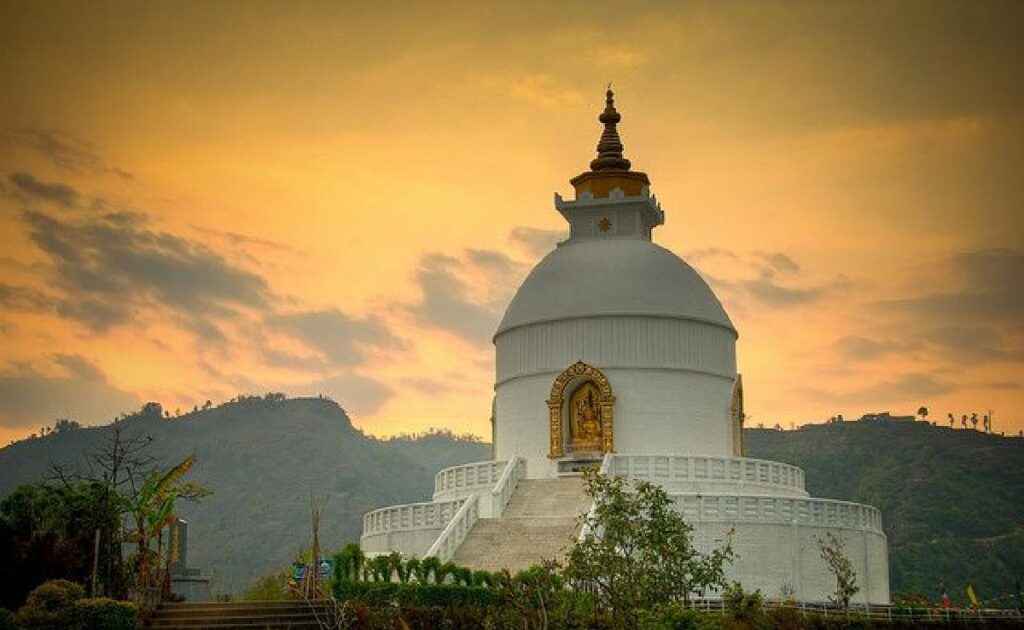

Strengthen Winter Branding

Position Nepal as “More Than Mountains”, highlighting culture, cuisine, festivals, spirituality, wellness, and soft adventure.

Role of Himalayan Circuit

As a Nepal-based tour and trekking specialist, Himalayan Circuit aligns its offerings with Nepal Tourism Board guidelines, focusing on responsible tourism, premium experiences, and authentic journeys. From Himalayan trekking and cultural tours to luxury travel, the company contributes to higher visitor value while preserving destinations and communities.

Conclusion

Tourism in Nepal in 2025 is stable, trusted, and investable, with strong foundations firmly in place. Looking ahead, growth will rely less on increasing arrival numbers and more on enhancing visitor value, upgrading experiences, strengthening destination branding, and targeting the right markets.

Through strategic planning, smart marketing, and close collaboration between the Nepal Tourism Board and responsible private-sector stakeholders such as Himalayan Circuit, Nepal is well-positioned to emerge as a high-value, sustainable, and globally respected destination in the years ahead.